As a comprehensive manufacturer of insulation, transmission, and wave technology, Nissei Electric aims to meet the niche market needs of customers in a wide range of industries.

Can you give us a brief overview of Nissei Electric and your business model?

The Company is an electrical and electronic components manufacturer established in Hamamatsu City, Shizuoka Prefecture, east of Lake Hamana, in 1969. We develop, manufacture and sell wires, cables and tubes made mainly from fluoroplastics and silicone rubber, and their processed products, as well as optical components, mainly fibre optics. In addition to the characteristics of the materials, our unique processing enables us to meet the demands of a wide range of industries.

The basis of our business is, as stated in our management philosophy: 'Do our best, Something only we can do.' Our mission and existence value are to solve the demands and problems of the market and customers with our technologies and products. We value niche markets that recognise the value of our products and services, even if they are small in size. Darwin's famous theory of evolution states that only those who can respond flexibly to their environment will survive. It can be said that the organisms that have survived the 3.5 billion years of evolution of life have been able to find areas where they can become number one. The same applies to business, where it is important to constantly search for areas where you can win in response to changes in society and the market.

At the time of our establishment, our business started with the automotive and household appliance sectors, using the heat-resistant properties of our materials as a weapon. Over time, we have expanded into diverse industries such as OA, telecommunications and factory automation, making full use of the various properties of materials such as low friction, non-adhesion, transmission and mechanical properties, as well as our unique processing technology, and are aiming to further expand into robotics, medical equipment, semiconductor manufacturing equipment, mobility and other fields.

During this period, we have developed products to meet the demands of our customers, which has enabled us to create a variety of foundational technologies. We are grateful to our customers for the development opportunities they have given us.

Our technologies are used in many products, "it may be somewhere unexpected, yet inevitable, with the technologies being the ones befitting" is our corporate slogan.

In the past, and still today, we have focused on increasing the value of our customers' products, and this will not change in the future. Focusing on niche technologies, creating functions that may not be obvious but are unique to us, and creating and deepening foundational technologies to meet further market demands - this is our core business model. We also focus on the BtoB market by being a component manufacturer (we do not sell finished products to end-users) in order to increase our competitiveness.

Our products are used in a wide variety of industries and we are working to cultivate new markets. We mainly target Japanese companies as we believe there are areas in Japan where our niche technology can increase the value of our customers' products. There are a number of global companies in Japan and we intend to expand our business into overseas markets through them. At the moment, we do not see M&A or partnerships with foreign companies as a means to our own growth. Our focus is on understanding our strengths and finding areas where we can utilise these strengths.

As a production base, we built our first factory in China in 1993, followed by Vietnam (Ho Chi Minh City) in 1999, and subsequently expanded our production locations within Vietnam and to Thailand and India. Instead of relying solely on the labour cost advantages of the overseas expansion, we were able to increase our cost performance by introducing state-of-the-art production equipment and, in addition, by producing some of the material processes in-house. Procuring the base materials for the conductors and producing the wire drawing and twisting processes in-house was effective in reducing logistics costs. We also felt that we should contribute to the countries in which we operate, so we have provided local staff with basic education in mathematics, physics, chemistry and other subjects, as well as Japanese language training. In Ho Chi Minh City, Vietnam, we were one of the first Japanese companies to build a dormitory for Vietnamese employees. These activities were highly regarded by the Vietnamese Government, and the relationship of trust built up, enabling stable production. Another factor that facilitated the smooth transfer of overseas production was the fact that Japanese was made the official language within the Group, so that Japanese staff could work in overseas factories in the same way as in Japan. As a result, a business model has been created whereby products are developed in Japan, mass-produced overseas and supplied to customers in Japan and abroad.

As for current challenges, we believe it is important to continue our efforts to constantly find new demands and capture niche areas by promoting automation and mechanization to further improve productivity in our overseas factories, while maintaining our existing business relationships in Japan and developing new markets.

Is there a specific application that you are currently focusing on right now? Do you have any new markets or applications that you are keeping your eyes on?

We look for applications where, in addition to the function of the material itself, the function realised by our unique processing technology is of value to the customer. In this sense, we target a wide range of industries, but every industry has its own "common sense", and we believe it is important to understand and research the common sense behind our customers' needs before commercialising our products.

In Japan, there are many companies just like yours, so how are you able to differentiate yourself from others? What do you believe is your unique selling point?

The foundation of manufacturing is QCD. In other words, it is measured by quality, cost and delivery time, and these three must be at or above the same level as other companies. In addition, we believe that gaining the trust of our customers is what differentiates us from our competitors. In terms of the COVID-19 epidemic, there were lockdowns in overseas production countries and, to be honest, we could not even foresee when we would be able to deliver the product to our customers. From the perspective of BCP (business continuity planning), the establishment of a mutually complementary production system between multiple plants is also important, and measures are being implemented.

Japan is a rapidly aging country with a shrinking population, causing issues such as a labour crisis or a shrinking domestic market. What are some of the challenges and opportunities this demographic shift is presenting to your firm?

There are certain industries where Japanese companies maintain a high market share and presence in competition with the rest of the world. We believe that there are industries in which we can play to our strengths, and we conducted our business with a focus on Japanese companies. Japan's declining population will lead to a decline in development capacity, but for us we believe this will be a strength for the Group as we are increasingly collaborating with overseas production sites. Japanese and overseas staff can work together, for example, from the product development phase, with some prototypes being made at overseas plants, and mass production being started up in Japan first to build up production know-how, before being transferred overseas when volumes increase. This demographic change is also an opportunity for us to expand our overseas operations, as many Japanese companies are not only carrying out production activities overseas but are also using their overseas bases to carry out the development process. We will work to capitalise on any opportunities.

Engineers are crucial in developing new products. Can you tell us a little more about your R&D strategy and are there any new products or technologies that you are working?

In the course of market research focused on identifying market needs and seeds, we search for and conduct research on themes that may be required by the market in the future. By developing new foundational technologies and measuring data in advance on such aspects as small diameter, light weight, flexibility, high density, high capacity, ultra-high/low temperatures and high durability, we are prepared to respond immediately as soon as market demands emerge.

Are you looking to find partners in Japan to help potentially expand into more new markets?

We want to be a good partner for our customers, working together to develop the requirements they want to realise. Ideally, we are not just a supplier of low-cost parts, but a relationship that enables us to offer products and services that are of value to our customers and for which there is no alternative.

Your products are used in the automotive sector, a sector that is going through a once-in-a-lifetime transformation with the shift to EVs, but by extension, Connected, Automated, Shared, Electric (CASE) vehicles are becoming essentially computers on wheels, and the cost of electronic components in relation to the total value of the car is expected to grow to 35% by the year 2025. What opportunities do you see for your firm with this switch to EVs?

We have a lot of experience in dealing with car manufacturers that produce internal combustion engine vehicles (ICE), so we are working with them to discuss what is needed for the future of CASE and EVs. We are currently researching what we can do on site, because we believe that in the CASE era there are new needs that we can address with products embodied in our foundational technologies.

One product that caught our eye is your next-generation high-speed transmission interface cables which can handle transmissions that exceed 10 gigabytes per second. This will be interesting considering over the next 10 years, billions of devices will be connected with IoT systems. Can you tell us more about your GIGA EX and some of its applications in terms of IoT systems? What are its strengths?

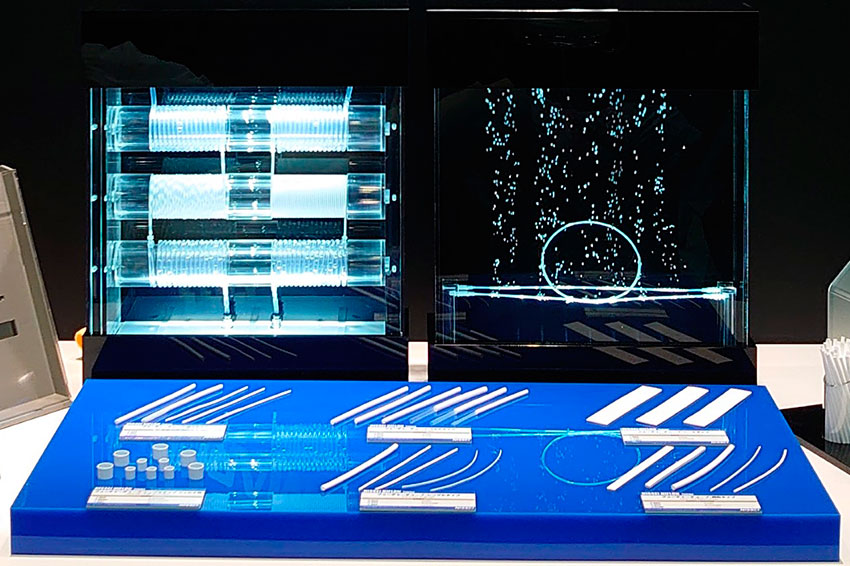

High-speed transmission and durability are required for communication interfaces between industrial devices. To make the most of our strengths, we have a line-up of cable products that are thin and flexible, and have functions such as resistance to bending, twisting and noise. The entire range of high-speed transmission interface products (metal transmission, optical transmission and wireless transmission) is collectively known as the GigaEx series. As an example, we have developed the world's thinnest Ethernet cable with an outer diameter of Φ4 mm and cable-to-cable joint components. The joints of the articulated robots on display in the showroom have a very small internal wiring space, so using our thin cables should increase the degree of freedom in robot design.

Electronic components are getting smaller and smaller as technology advances. As a manufacturer of electrical cables and electronic components, how are you adapting your products to suit this miniaturization trend?

Our strength lies in analogue microfabrication technology, and we strive not only to reduce the size of the product itself, but also to add more advanced functions to it by means of precision processing. For example, we have developed foundational technologies such as opening microscopic holes in ultra-fine fluorine tubes of less than 1 mm in diameter to make them compact and, in addition to the chemical resistance of the fluorine itself, to give them a degassing function.

You mentioned that you will be supplying products to overseas markets according to their needs. Are there any specific countries or regions that you are thinking about developing in the future?

As for production bases, we have recently set up a plant in India, so for the time being we will concentrate on stable production. As for sales bases, we currently have sales offices in China and Thailand, where we conduct sales in the Chinese market and the rest of Asia. In Europe and the USA, we have customers but no direct sales offices. We will consider sales bases as necessary, keeping an eye on the market and customer situation in the future.

Imagine that we come back in five years and have this interview all over again. What goals or dreams would you like to accomplish by then?

Five years from now, which will be 2028, we will see a significant increase in the number of EVs around us, as DX advances in visualisation and decarbonisation activities in various industries become more apparent IoT will spread rapidly, so our success as a company will depend on how we win customers and capture market value. The time span of five years is very short, so if we don't sow the seeds now, they won't bloom by then. We will promote our unique resource-saving business and optimise our position.

Interview conducted by Karune Walker & Sasha Lauture

0 COMMENTS