With the rise of EVs, cars have become less complex and as such, JATCO is diversifying its product line-up to reflect this trend, even producing electrified powertrains on behalf of Nissan.

What do you believe to be the strengths and core competencies of JATCO that set you apart from your regional manufacturing competitors and have allowed you to achieve the dominant global status you enjoy today?

While it is true that Japan has faced challenges in certain markets, such as semiconductors and electronics, it still possesses strengths in areas like quality, safety, and discipline. Despite not having a national religion or belief in a specific God, there is a strong cultural sense of duty in Japan that leads us to focus intensely on one thing, which raises the quality of our products. However, Japan has faced competition from cheaper and somewhat lower-quality products, affecting its overall competitiveness.

In terms of battery technology, we take pride in the fact that the batteries used in Nissan EVs have never broken down nor caused fires anywhere in the world. This reflects the core strength of Japanese monozukuri. However, the reality is that Japan has lost ground to cheaper and lower-quality products.

I agree with your observation that Japan’s strengths also lie in the many Japanese companies that have their own technologies and products that are widely used globally, but what I perceive as a weakness of Japanese manufacturing is its inability to establish substantial branding on a global scale.

While Japan itself is known for quality, individual companies often lack strong brand recognition, unlike companies in Europe and America. Our company is no exception in terms of the overall Japanese brand of quality and safety. We have gone past PPM levels in our quality control and are about to enter the PPB (parts per billion) field. That is our strength.

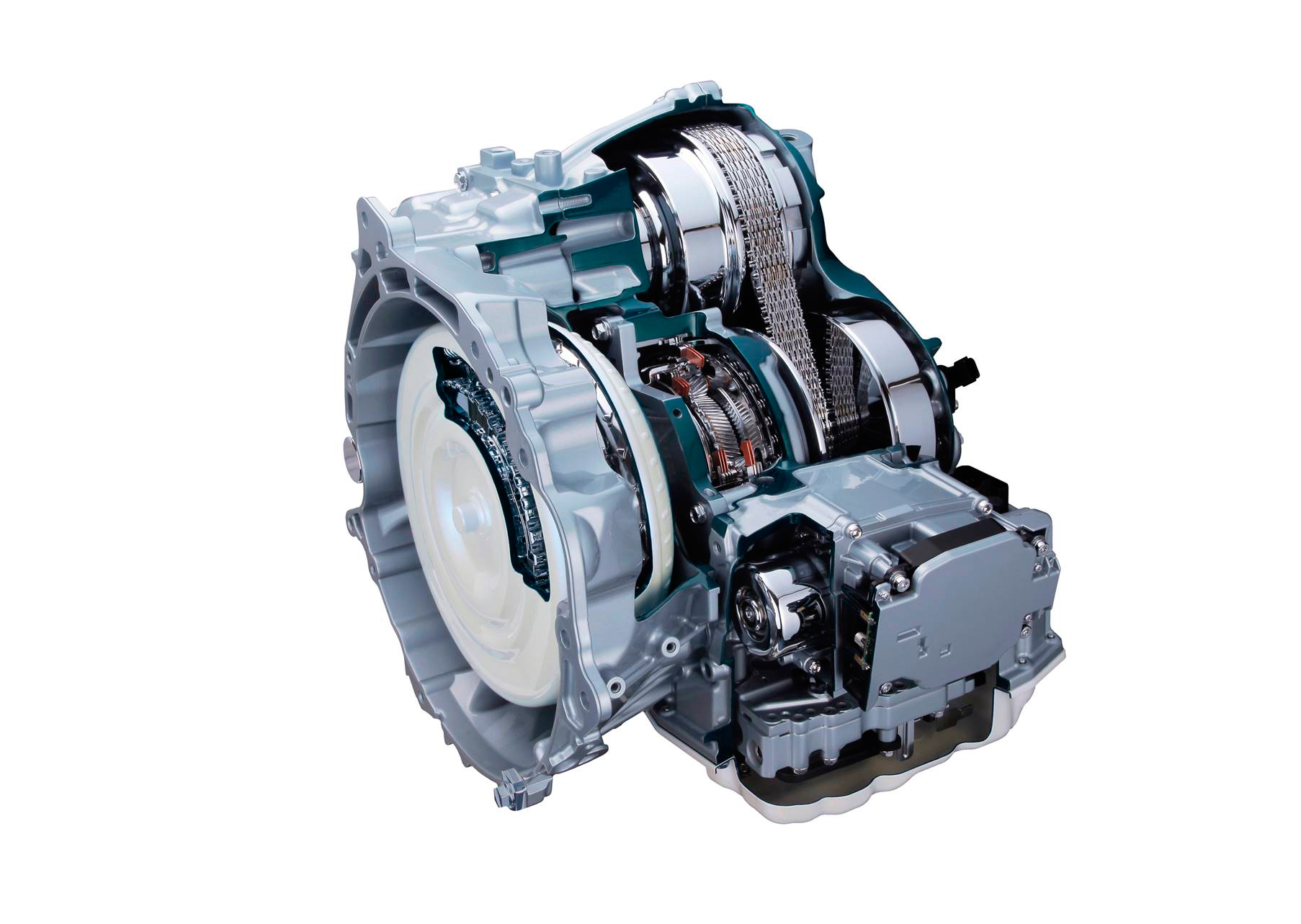

Our development of CVTs, starting around 1997 and 1998, was challenging, even with all the experience we had gained up to that point, and we encountered numerous belt failures. To address these failures, we conducted thorough investigations to learn from each one and make improvements. These improvements were then integrated into our production system, where we standardized processes, allowing any operator to manufacture consistently, regardless of their background. This standardized production is a strength of not only our company but is prevalent throughout Japanese companies. Japanese companies use this detailed documentation of production as part of their system to thoroughly train each and every employee.

This thorough documentation has recorded our successes in building challenging components like belts, pulleys, belt and pulley control systems, and gears. As such, our core competence lies in the accumulation of technology that remains even now in our factories from when we first began building CVTs.

Our two biggest strengths are first, our expertise in gear design, production, and application in vehicles. Secondly, we excel in controlling drivability, as many drivability characteristics were controlled through the CVT system. Another strength lies in the extensive data we have collected through numerous tests on the response of the human body to various driving situations, enabling us to enhance driver comfort in our vehicles. These strengths are closely aligned with the Japanese monozukuri spirit.

Jatco CVT-X: CVT for medium to large FWD vehicles

While components such as CVTs may not be as indispensable for EVs as they were for traditional internal combustion engine (ICE) vehicles, they still play an important role in the functioning of the motor. I would like to hear your thoughts on how this sector shift towards EVs has impacted your company, and what changes or transformations it has inspired in your operations in the medium to long term.

The shift to EVs represents a significant revolution that occurs once in a century, and the strengths I mentioned above are foundational in our efforts toward this transformation. The most significant impact on JATCO from this shift to EVs is the change in the number and type of components. Cars are becoming less complex, and we need to adjust accordingly. To maintain our current business size, it is crucial for us to expand our product portfolio and increase production.

As I mentioned earlier, one of our major strengths is in gears, and in the context of EVs, where quietness is important, our gears become a highly viable option. Additionally, we can contribute transmissions that play a key role in improving the efficiency of electricity consumption. In particular, a lot of electricity is consumed when accelerating from a stop or during a high-speed cruise at over 140 or 150 kilometers per hour, and using a high-geared transmission can mitigate these efficiency shortfalls.

Another strength we have is our ability to control drivability. We aim to collaborate closely with automotive manufacturers in the design of EVs so we can leverage our expertise in shaping the driving experience. These two pillars—transmission technology and drivability control—are our current approach toward the shift to EVs.

You produce electrified powertrains on behalf of Nissan, in a collaborative effort. Obviously, demand for this kind of product is going to exponentially increase alongside the EV transformation. Could you elaborate for us about that relationship and the role that JATCO will play in supporting Nissan’s electrification plan?

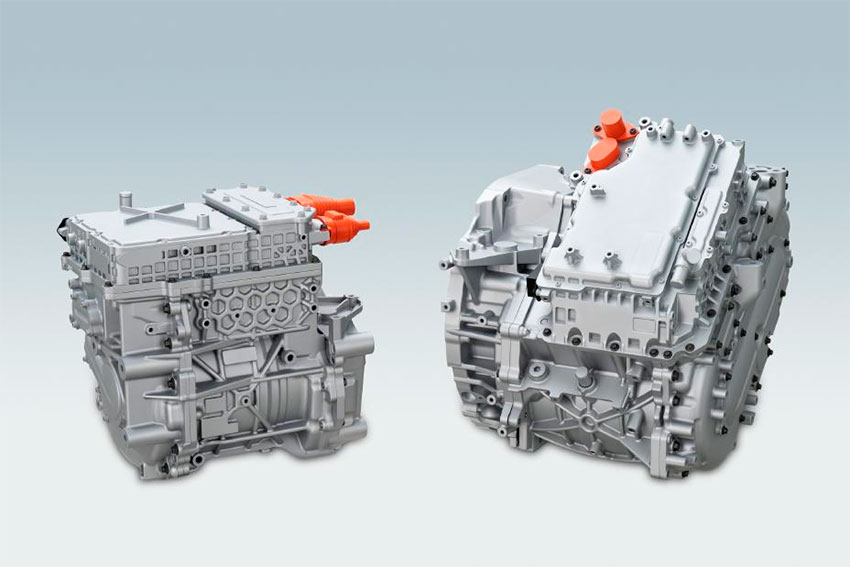

Regarding our collaboration with Nissan, we are grateful that they have highlighted our role and announced our collaboration, placing us at the center of their production plans. This collaboration began around three years ago, with roughly 200 members of our development team dispatched to Nissan to support the development of the X-in-1, their new EV powertrain approach.

Given this, we have been developing motor technology, inverter technology, and related control technology, while concurrently learning about effects that are different compared with CVTs, most notably those related to the effects of electromagnetic noise on EV systems.

As part of these efforts, testing functions at Nissan’s Zama Operation Center have been transferred to us, and we are now conducting tests in various conditions of our e-Axle EV systems. We are also collaborating with partner companies such as Hitachi Astemo, formerly known as Hitachi Automotive Systems.

Nissan X-in-1 electric powertrains: 3-in-1 for EVs (left), 5-in-1 for e-POWER (right)

I'm curious to learn more about the importance of collaborations for your company and how they contribute to transforming your image beyond CVTs. It's fascinating to see how you've expanded your R&D activities into motor powertrains, axles, converters, vibration and noise control, addressing various concerns related to this transformation through partnerships. Are you actively seeking new partners, whether they are automakers within or outside of Japan, to further develop and gain exposure to their technologies and markets, similar to your collaboration with Hitachi?

Our stance is that we are actively open to collaboration with other companies, as we are both making and fielding requests for collaboration. I cannot disclose much more, but we are already engaged in a number of collaborative projects, both domestic and overseas.

I have a question about part of your very first answer in this interview where you talked about the issue of branding for Japanese companies. The report we're writing is called “the hidden yet indispensable value of monozukuri”. We've heard from many interviewees about how this kind of horizontal international collaborative model can be an important step in shedding that reputation. What should and can Japan do to improve its branding?

From my perspective, to address the branding issue, there are two approaches to consider: the horizontal approach and the vertical approach. In terms of the horizontal approach, Japanese component companies have achieved a modicum of success in their branding. However, one of the most successful horizontal branding approaches has been Intel’s strategy with “Intel Inside,” where they showcased their brand front and center to display the value inside, yet many Japanese brands are too reserved to push their own brand forward with such a strategy.

The vertical approach pertains to the business-to-consumer (B2C) model. European makers are leveraging this approach very well. For example, Daimler makes strong use of their brand in their sales strategy.

Nevertheless, the branding strategies of Western companies may be difficult for Japanese companies to implement directly. Japanese companies should shift the focus to promoting the quality and safety of their brands, telling consumers that by purchasing their brand, they can be confident that they are acquiring high-quality and reliable goods. Additionally, they can build brand recognition and loyalty through their sales strategy.

JR913E: JATCO’s 9-speed AT for RWD vehicles

You have already established yourself as a top global manufacturer in your field, serving clients and having offices in various locations around the world. I'd like to know what's next in terms of your international strategy. Are there any upcoming plans or announcements you can share with us today?

For the next 20 years, the automotive landscape is expected to be bipolar, with areas where internal combustion engine (ICE) vehicles will still prevail, such as Asia, Africa, and other regions. Electric vehicles (EVs) will be more prevalent in areas like China, Europe, and the USA, although this transition may occur gradually. It is crucial for us to assess the global situation and strategically position ourselves accordingly.

Currently, our main focus in international expansion lies in penetrating the European market and strengthening our presence in the Chinese EV market. New domestic Chinese EV manufacturers are continually emerging, with customers trending towards them, and with the potential conversion of existing ICE companies to EVs very hard to predict, we are keeping a very close eye on that market.

In Europe, we anticipate a complete transition to EVs in the future. Therefore, we are concentrating on entering this market successfully. In Mexico, we foresee a coexistence of ICE and EV vehicles for a certain period, and since we have two factories there, we will balance our operations accordingly. As for Thailand, our intention is to maintain our ICE presence there, although we are monitoring the changing regulations imposed by the Thai government.

Let’s imagine that in the next five years, we conduct this interview again. What would you like to share with us?

First and foremost, it is our goal to achieve the production of 5 million EV units by 2030, as we announced last year. To achieve this, forging partnerships with individuals and companies is of utmost importance. By creating a robust collaborative framework, we aim to become a leading supplier in this specific domain. That’s my goal.

Interview conducted by Neale Oghigian & Sasha Lauture

0 COMMENTS