Empowering industries with cutting-edge wet milling technology, Aimex is at the forefront of innovation.

To begin, we want to get your take on the premise of this report. We are definitely of the opinion that Japanese manufacturing is living a very exciting time. In the past three years, with supply chain disruptions from Covid, we are seeing multinationals around the world looking to diversify and strengthen their supply chains in the context of the US and China’s frigid relationship. Known for their great reliability and advanced technology coupled with the JPY being very weak, we think this is a very interesting and opportune moment for Japan to present themselves as being cost-effective perhaps more than any other time in history. We would like to hear your take on this. Do you agree with this premise, and what do you think are the key advantages or strengths of Japanese suppliers in the current macro environment?

I agree with you. Due to the weaker JPY, we have some advantages. Of course, there are downsides as well, with higher energy prices and higher electric bills that impact the manufacturing sector. However, from a macro point of view, the Japanese economy will enjoy a better export situation due to the weakened JPY. This is especially good for exporting companies, with the exchange rate being one of the major factors for producing profit for the automotive sector. We also export machinery overseas. This has also been helped by the weaker JPY. Most of our materials are procured from Japanese companies. For example, we procure our materials from one electric company. However, they export these materials from their base in China. This means that we are indirectly impacted. Also, due to supply chain disruptions, the motor inverter has a longer lead time, and this has impacted our operations. However, overall, I believe that the weaker JPY is better for us than the higher JPY.

You make an interesting point about how there can be no opportunity without a challenge. I think the big cloud hanging over Japan at this time is the aging population. Even if the manufacturing is great, if you do not have the human resources to create the great monozukuri, then where are you? I want to ask you how this is impacting Aimex in two ways. First, you mentioned that you are a pioneer of wet bead milling in Japan, and your company has a lot of accumulated expertise. How are you going to inherit that technology and pass it on to the next generation? Secondly, in terms of recruitment, it can be challenging to find young people who are enthusiastic about a manufacturing career. In these two respects, how are you managing? What is your strategy to succeed in such a difficult environment?

It costs us to recruit good talent. This requires money. To produce this money, we have to make a profit. Over the last two to three years, I have executed a sales reform. In the conventional approach to sales, once we implement the machinery and equipment to the customers, we just wait for other orders to come in for parts and maintenance. However, salespeople are not aggressive in that approach and are just waiting for orders. I believed that we should not have been taking that approach, and rather that we should be more proactive when it comes to sales.

We launched a new department called our inside sales division, to nurture the inquiries that we receive. Our inside sales team follows up on those inquiries and turns them into real sales that are then passed on to our sales divisions. We also established a system to visualize our sales approach and keep it on record. Before that, we depended on personal knowledge when it came to sales progress and customers. However, by introducing this new system, everyone can see the status of all the inquiries. Another initiative that we have been doing is SEO. Once people search keywords, our company is at the top of the list. We need to stabilize our sales divisions as that will lead to receiving more orders which will boost our sales. With the profit that we generate, we can focus on equipment activities. This cycle has been running well for us.

When it comes to hiring, we focus on hiring both mid-career workers and new graduates. We recruited two people in June and two people will also join us in July. Therefore, the number of employees working for our company is increasing.

It is very interesting to hear how you are putting a lot of emphasis on your sales divisions with this new department. We have established why you are in a very good situation to have your eyes out on the global market. This is also because you procure and manufacture in Japan and you have a record of exporting. Why do you think overseas customers that are sending you inquiries should choose Aimex for their needs? What would you say to be your core strengths and competencies that would make you the best choice for prospective clients in this field?

I believe that our best competitive advantage is our technology. Our main focus is our bead mills and our 3-roll mills. Our customers have materials that need to be pulverization and they want to know how finely these materials can be pulverization or dispersion. After that process, it has to maintain the same status for long time so that it is stable enough. That stabilization is very important from a quality perspective. We can ensure this quality.

I do not believe that all of our products are appealing to every industry. However, our products are highly appreciated by clients with high demand and high criteria, such as MLCC or the materials for fuel cells or nano inkjet. They have very high criteria for quality, and therefore those industries appreciate our products and technologies. On the other hand, agrichemicals or paper making for example have lower criteria, and therefore can use cheaper machines.

You just talked about how your products are highly appreciated by really quality-sensitive sectors such as MLCCs. However, you also focus on paper making, pharmaceuticals, and cosmetics. Would you say that you are focusing more on these quality-sensitive sectors as a target or focus area for your sales?

When it comes to the sectors such as paper making and agrichemicals, our Japanese customers are also demanding higher criteria. However, some overseas clients’ demands are not as high.

We are focusing on overseas customers that require a high standard of quality. The reason for this is that when it comes to industries with lower criteria, if we submit a quotation, it may not be cost-effective for them, and therefore they are not interested. However, Japanese machines are cheaper than European machines for Chinese companies.

We would like to ask you about your wet-dry processing technology. As I understand, the advantages of wet processing over dry processing are when it comes to energy efficiency and heat dissipation. The negative side is durability. We see that with wet processing, you need more maintenance and more aftersales. For these foreign clients overseas, how are you providing this kind of service? How are you compensating for this durability drawback, and providing this extra level of care for your overseas clients?

Wet grinding is finer. It is used for particles that are less than one micron. Otherwise, we use dry grinding. Therefore, depending on the size of the particles, we use different methods for grinding.

When it comes to maintenance, I do not think there is any difference between the wet and dry grinding methods. All machines and equipment require maintenance and proper care, as the parts become worn over time. As for the aftersales services, in most cases, we replace the worn or troubled parts. That is the main solution. However, if very serious issues occur, our agent in the local area goes there to check. In the worst-case scenario, our engineers from Japan will go to the location. This does not happen much, and in most cases, the replacement of parts is enough. Since the Covid outbreak, more and more meetings have been done online. This allows us to check and confirm the status without having to physically go onsite.

Is there an opportunity to install pre-emptive maintenance solutions such as digital monitoring tools or is that something that is not viable just yet?

That is not yet viable. We could check some parameters such as the temperature, pressure, vibration, or electric power, which would allow us to adjust the best timing for the maintenance. However, at this moment, we do not have any concrete measures in place.

In the meantime, you mentioned that in these extreme cases, you have some agencies and partners that you work very closely with such as Sun Chemical for China or Taiwan for example, who can go onsite and do the maintenance work. As you continue to expand your horizons and open up to new customers and new markets, are you actively seeking new kinds of partnerships or establishing new relationships with local companies and distributors, as you have with Sun Chemical?

For Taiwan and China, we have an exclusive agreement with Sun Chemical. Therefore, we are not seeking partners in those locations. However, when it comes to other countries such as Vietnam and Thailand, if there is an opportunity, then maybe we could seek a partnership with a new company in that area.

Are Southeast Asian countries such as Vietnam and Thailand the next horizon that you are thinking about? Would you say that Southeast Asia is the focus of your international development strategy? If not, then what countries or regions do you have your eye on?

Asia is our main focus, as we have many competitors in Europe. The industries that we focus on can expect a lot of growth in the future in Asia. This includes India and other countries besides China. Industries such as electronics and cells require high development, maintenance, and management. However, I am not sure that the manufacturing sectors in some Asian countries have reached that level yet. Therefore, perhaps when our Japanese customers enter these markets, we can go along and support them. However, at this time, we have not decided on which country will be our next focus. China is a market that is still growing, especially when it comes to the industries that we focus on, such as electronics. Therefore, there is room for improvement there.

You mentioned a couple of times that the real core of your company is your technology. A great example of this is the Delta-V disk for super fine particles. With the middle being one micron, you go very far to the left. Could you tell us more about the current focus of your R&D strategy or product development strategy? Is there a new technology or product that you are planning to bring to markets soon that you could share with our readers?

From May 17th to 19th of this year, there was a trade exhibition in Osaka, where we released our new product the DAM-5 model bead mill which is good for soft dispersion with appropriate strength and higher frequency. This allows us to maintain the structure of the particles. It can be used on MLCC materials and titanium oxide materials for electronics.

DAM(Soft dispersion Bead mill)

Your company was established in 1950. In 2030, you will be an 80-year-old company. Imagine that we were to return in seven years, to reconduct this interview all over again. Is there a certain goal or personal ambition that you would like to have achieved by that date?

I have some personal goals that I would like to have achieved by 2025.

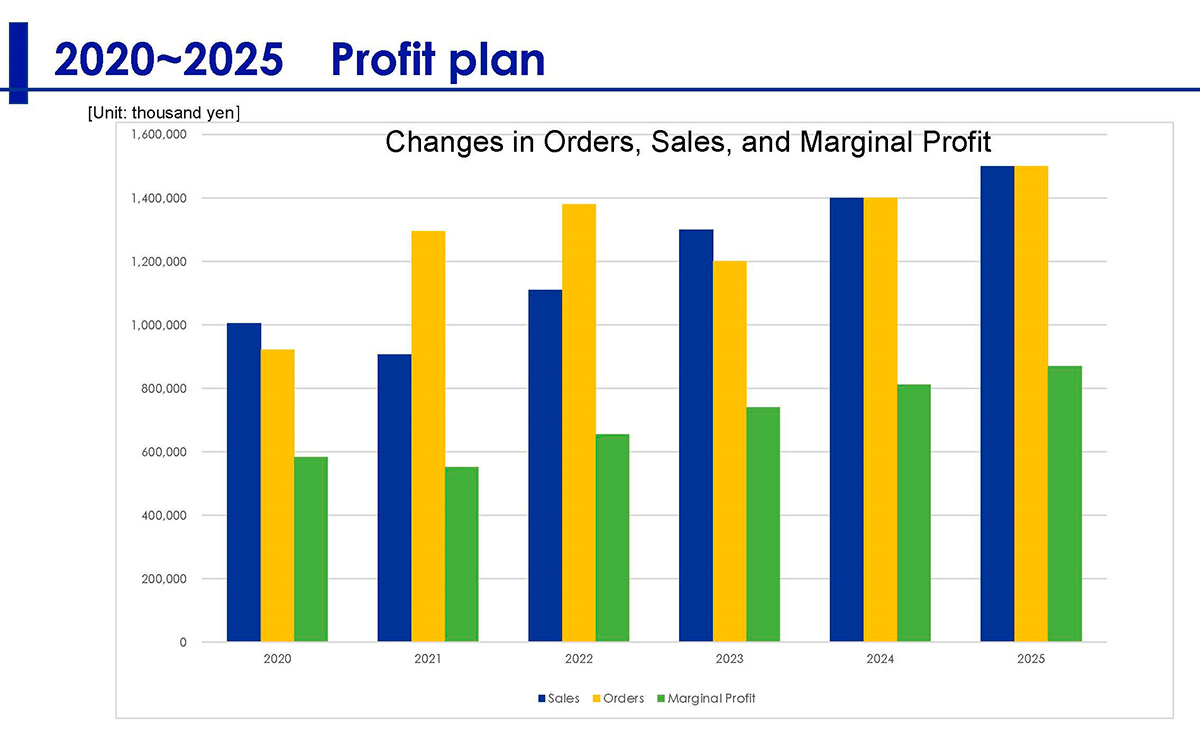

Company projected revenue (blue bar)

I joined this company in 2005. Three years later, the Lehman Shock occurred. We suffered huge losses as our profits and sales nosedived. Our company’s existence was at risk at that time. However, since then, and despite the Covid outbreak, we have kept growing. This has been due to our standardization, our development, and the changes that we made to our sales divisions. We were in the red at that time. However, we reviewed our production structures and we integrated our sales locations and manufacturing sites. We were also able to acquire patents.

My goal for 2025 is for our sales to reach JPY 1.5 billion. This is the financial goal that I want to achieve by then. I would also like to strengthen our marketing. As I mentioned earlier, through automation and manpower saving, we want to be able to visualize all the parameters such as temperature, vibrations, pressure, and so on. This will help to further boost our sales.

Another one of my goals is to expand our consigned processing business. For example, we receive the materials from customers and we then process the grinding of these materials into nanoparticles. These are then returned to the customers. Our structure should be supported by our sales team, and our sales should drive our growth. Rather than expanding our business horizontally, we want to deep-dive into our specialized areas. Those are my goals for the future.

Is that consigned processing business solely domestic based or will you be doing it internationally as well?

For now, that business will only be based in Japan. We do not know what will happen in the future.

0 COMMENTS